Taxes: Why do we have to have them? Why do we have to pay them? Where do they go after we pay? Many people want to know and get answers, but there are still many people who misunderstand taxes, such as:

The belief that only working people and entrepreneurs pay taxes is incorrect. In fact, all Thai people have to pay taxes.

On the working side, some people or groups with high salaries understand that “they are being taken advantage of because the taxes deducted from their salaries each month are used to support or help people with low incomes.”

As for the low-income group that still has to pay taxes, many are dissatisfied, saying that “the tax reduction measures that were issued were issued to help those with high incomes, which is not fair to them.”

And there are many questions and feelings about taxes, such as, “This way, people with low incomes will be comfortable and not have to take any responsibility,” or “Many working people feel that it is unfair that they are the only ones paying taxes,” or “Many working people still understand that they are shouldering the burden of Thailand,” or “Only working people and entrepreneurs shoulder the burden of taxes and the burden of the country,” and so on.

Taxes, why do we have to have them, why do we have to pay them? I want to tell you the truth: all Thai people have to pay taxes.

Children pay taxes, monks pay taxes, and senior citizens, even after retirement, still have to pay taxes. All ages, regardless of whether they have income or not, all pay taxes because taxes are part of our daily lives. For example:

For example, a 10-year-old boy’s father gave him money to buy bread and juice at a convenience store. Although the price was not much, if we look at the details of the receipt, we will find that Value Added Tax (VAT) is included in the total price of the products.

Or a father drives his son to school in the morning. On the way, he stops to fill up with gas at a gas station. If we look at the receipt, we will find that there is also Value Added Tax (or VAT) included in the cost of our gas. However, for every baht we fill up with gas, the oil company must also pay additional excise tax.

Or if your father works for a company, your father receives a salary, so he must pay personal income tax. If the company receives results and income, then it must pay corporate income tax, etc.

Therefore, from the time we are born until we die, we all have to face taxes, either directly or indirectly.

What are taxes and why do we need them?

Tax is something that the government forces on its citizens.

According to the Constitution of the Kingdom of Thailand, in addition to specifying various rights that citizens should have, it also specifies the duties of citizens who must pay taxes as prescribed by law. The law used as a stipulation for tax collection is the Revenue Code.

The history of taxes in Thailand has a history that dates back to before the Sukhothai period. According to evidence from the stone inscription of King Ramkhamhaeng, which shows evidence that taxes have been collected since before the era of King Ramkhamhaeng, the tax at that time was called “Jokop, Jamkop, or Jangkop”, a type of tax collected from people who brought animals and goods to sell in various places, or referring to taxes collected from animals and goods imported for sale.

Tax collection from the people is an important financial tool for the administration and development of the country in many areas such as the economy, education, public health, transportation, public welfare, national defense and maintenance of peace within the country, public utilities, including salaries for government officials, soldiers, police officers, and those who provide services to the public, etc.

“ Taxes are the source of the country’s income .”

All Thai people must pay taxes because taxes are the country’s main source of income.

Taxes are divided into 2 types: “Direct taxes” are those paid by the taxpayer himself (personal income tax, corporate income tax, petroleum income tax) and “Indirect taxes” are those collected from other persons but the taxpayer must bear the burden in one form or another (e.g. Value Added Tax, Specific Business Tax, Oil and Oil Product Tax, Import-Export Tax, etc.).

Therefore, it is not possible to say that children or the elderly do not have to pay taxes because all Thai citizens pay taxes, whether directly, indirectly, or both. It can be said that everyone around us, no matter what income or expenses we have, cannot avoid taxes.

Let’s take a look at the government’s revenue collection results for fiscal year 2019.

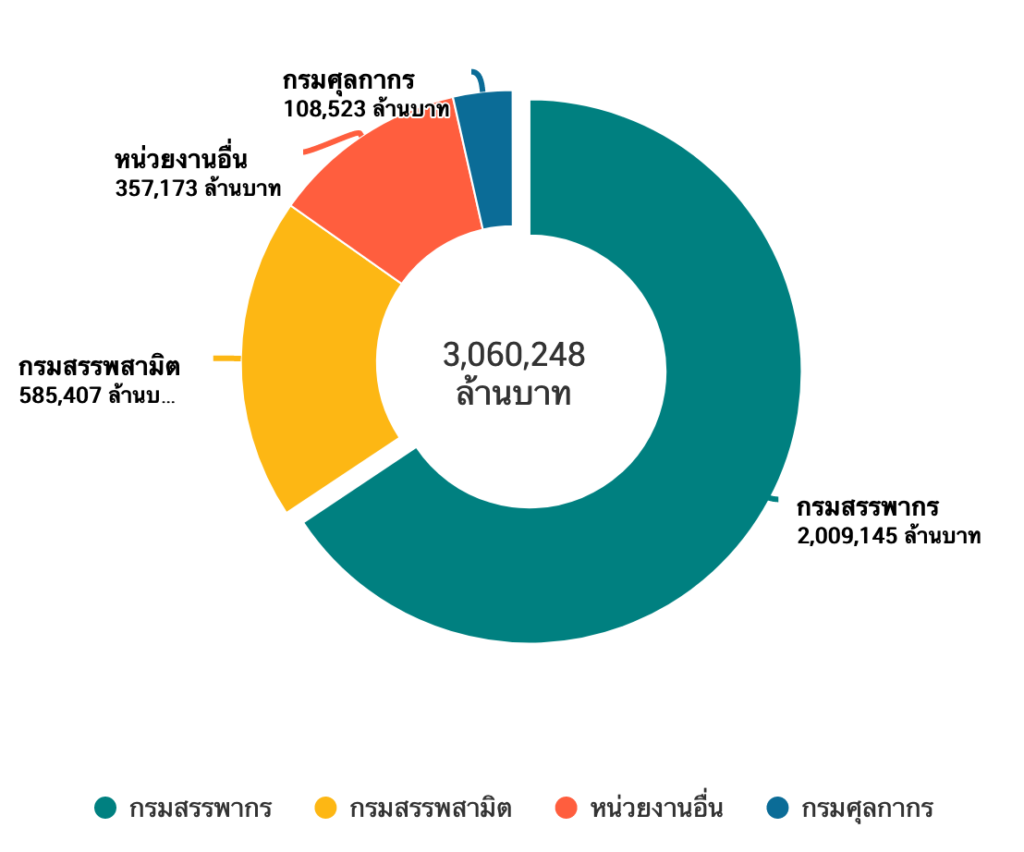

Almost 80% of the country’s income comes from tax collection, and about 65.65% comes from the Revenue Department, 19.13% from the Excise Department, 11.67% from other agencies (Treasury Department, state enterprises and other government agencies) and 3.55% from the Customs Department.

In the past, the State Enterprise Policy Commission Office reported the total revenue of state enterprises, finding that in 2019, there was a total revenue of 169,159 million baht. The top 10 state enterprises in Thailand that remitted the highest revenue to the country in fiscal year 2019

Let’s take another look at our country’s main source of income. Our all-time hero is the Revenue Department.

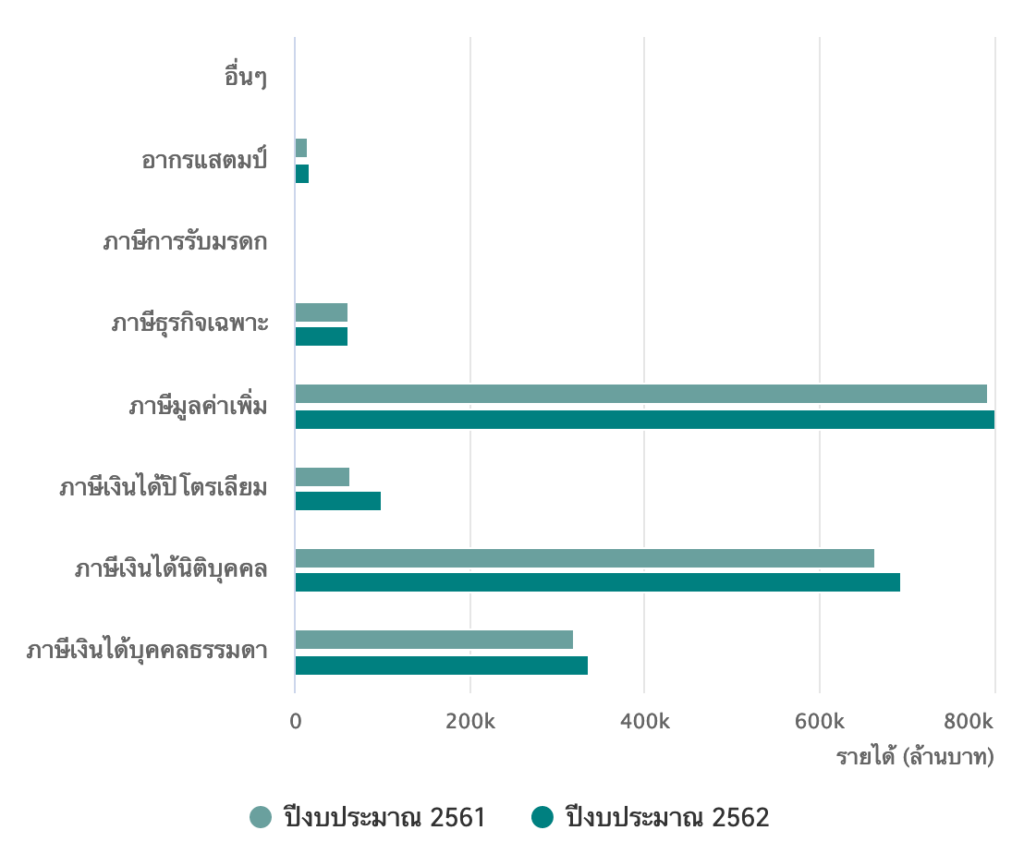

According to the results of tax collection by the Revenue Department in 2019, the first 40% came from VAT, 35% from corporate income tax, 17% from personal income tax, and the remaining 8% came from other areas (petroleum income tax, specific business tax, stamp duty, and inheritance tax).

This 7% VAT is what all Thai people have to pay and is one of the top incomes collected by the Revenue Department each year.

Corporate Income Tax

If the population in Thailand is around 66.5 million people, how many people or cases do you think are “entrepreneurs” or “business owners”?

According to the information available from the Revenue Department of Thailand, there were a total of 2,096,297 business operators who filed tax returns (in the 2015 tax year, this information may be used as an indicator because the number of business operators increases and decreases every year, especially in the last two years when there were a high number of business operators closing down). They can be divided into 2 groups:

Group 1 “Operating business in the form of a “company or juristic partnership” (filing Form Por.Ngor.Dor.50)” has a total of 510,371 entities, accounting for 24.35%.”

Group 2 “Operating businesses in the form of “individuals”, which is the largest group affected by the measure to reduce the fixed expense deduction to 60% (submitting Form Por.Ngor.Dor.90), totaling 1,585,926 persons, accounting for 75.65% of the total number of business operators.”

This means that Thailand has about 2 million “entrepreneurs” or “business owners” in the tax system, but they can send 694,606.74 million baht in taxes to the country.

Personal income tax

The population of Thailand in 2019 was approximately 66.5 million people, of which approximately 40 million were working-age and approximately 28.4 million were outside the tax system.

“About 11.6 million people file personal income tax forms (Por.Ngor.Dor.90/91), but only about 4 million pay personal income tax. The remaining almost 6 million do not pay taxes because their net income is less than 150,000 baht per year.”

There are only about 80,000 people with a net income of more than 2 million baht, or in the 30-35% tax base. But in total, taxes from all working people can send taxes to the country up to 336,227.42 million baht. It cannot be said that working people are not important.

What does the government do with the taxes they collect from us?

As we have known from the beginning, our country’s income comes from tax collection to be used for developing and administering the country in various aspects, such as the economy, health, gold card, education, building buildings or classrooms for schools, transportation, and being involved in building electric trains, roads, tunnels, and paying salaries to civil servants, such as soldiers, police, teachers, and others.

Or used to maintain peace within the country, including the construction of various facilities such as water pipes, government buildings, electric poles, street lights, etc.

If the people in the country do not pay taxes or avoid paying taxes, the government itself will not be able to find money to further develop the country.

Can we avoid or not pay taxes?

“No, no escape, no payment for taxes, is that possible?”

“Tax is something that the government compels from the people.” The word compulsory means that everyone has a duty to pay taxes (if they have a net income as specified or have other related taxes).

“Tax-related offenses, such as tax evasion, non-payment of taxes, or tax evasion, are criminal offenses.”

If you do not pay with the intention of negligence in order to avoid taxes, you will face severe punishment as follows: a criminal fine of up to 200,000 baht, imprisonment of up to 1 year, a fine of 2 times the amount of tax to be paid, and interest of 1.5% per month of the amount of tax to be paid, starting from the due date until the date of full payment.

If you decide to evade taxes, you will face severe punishments, such as a criminal fine of up to 2,000 – 200,000 baht, imprisonment of up to 3 months to 7 years, a fine of 2 times the amount of tax to be paid, and interest of 1.5% per month of the amount of tax to be paid, starting from the due date until the date of full payment.

You probably see the penalty. It’s not worth it if you choose to avoid or evade taxes. If you get caught, you may face both imprisonment and a fine. So the most important advice is to not have any problems.

Conclusion for this story

Taxes: Why do we have to have them? Why do we have to pay them? Now we probably have the answer because taxes are the country’s income and are something that all Thai people must pay.

Although we may have some questions in our minds, whether it is dissatisfaction with the government’s use of tax money or corruption problems that make many people not want to pay taxes to the government, but that is a problem that the relevant agencies must take action on.

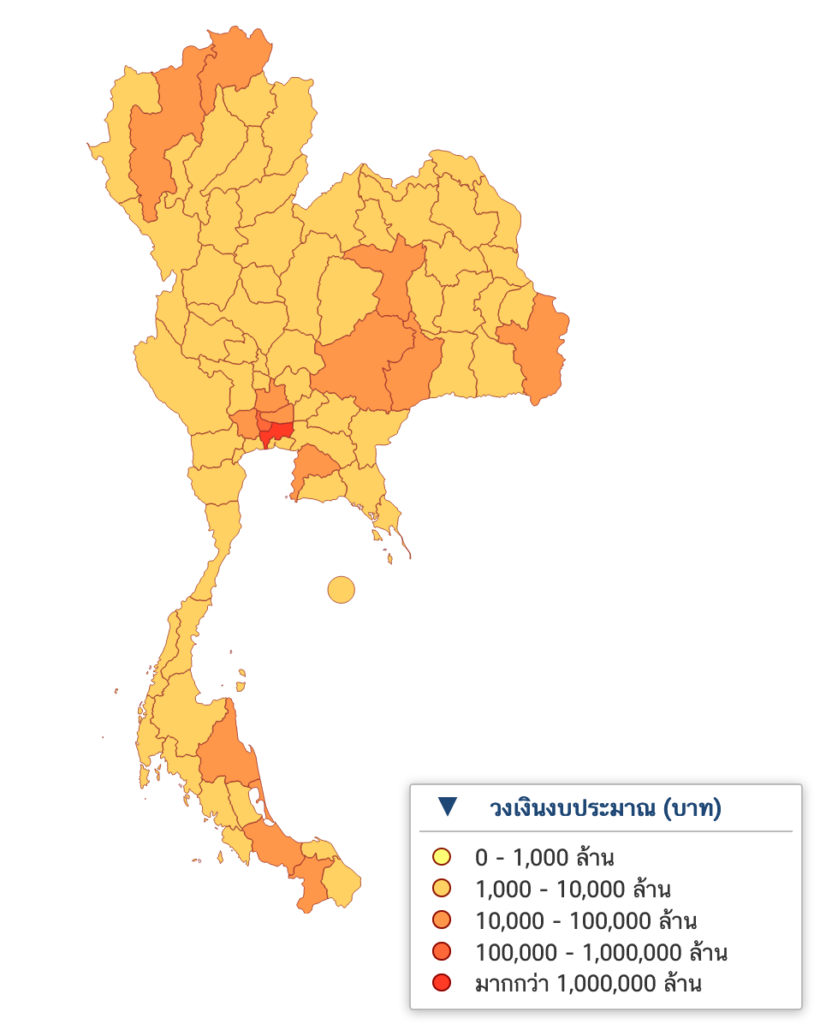

We can track tax collection or government spending through this channel: https://govspending.data.go.th/

For this reason, many people may not want to pay taxes, which is not wrong, but not paying taxes is illegal.

Therefore, for this matter, we must understand and perform the correct duties in the matter of paying taxes and must understand the matter of taking advantage of the tax deduction rights that are related to us or related to our business for the benefit of ourselves, our business and for the sake of correctness so that we do not have to regret it later.

Source: